The Future of Fintech: Blockchain, AI, and Cloud-Native Solutions

Introduction

Fintech is changing the way people and businesses handle money. It has moved beyond just online payments and mobile banking, as new technologies make financial services faster, safer, and smarter. Blockchain, artificial intelligence, and cloud-native systems are bringing this change by improving security, speeding up transactions, and offering more personalized experiences.

In this article, we explore how these technologies are shaping the future of fintech. They are helping build reliable systems, manage large amounts of data, and meet the growing expectations of modern customers, creating financial services that are easier to use and more accessible.

What is Fintech?

Fintech, short for financial technology, refers to tools and platforms that use modern technology to provide financial services. This includes mobile banking apps, digital wallets, online lending platforms, trading tools, robo-advisors, and many other solutions that make managing money easier.

Fintech is different from traditional finance because it is faster, automated, and focused on making things simple for users. Instead of waiting days for a bank transfer or filling out complicated forms, people can make payments, apply for loans, or track investments quickly and easily using their phone or computer.

Fintech is also helping more people access financial services, including those in remote or underserved areas. By combining technology with finance, fintech is changing the way we manage money and making financial services more convenient, safe, and easy to use.

Why Fintech is Growing Fast

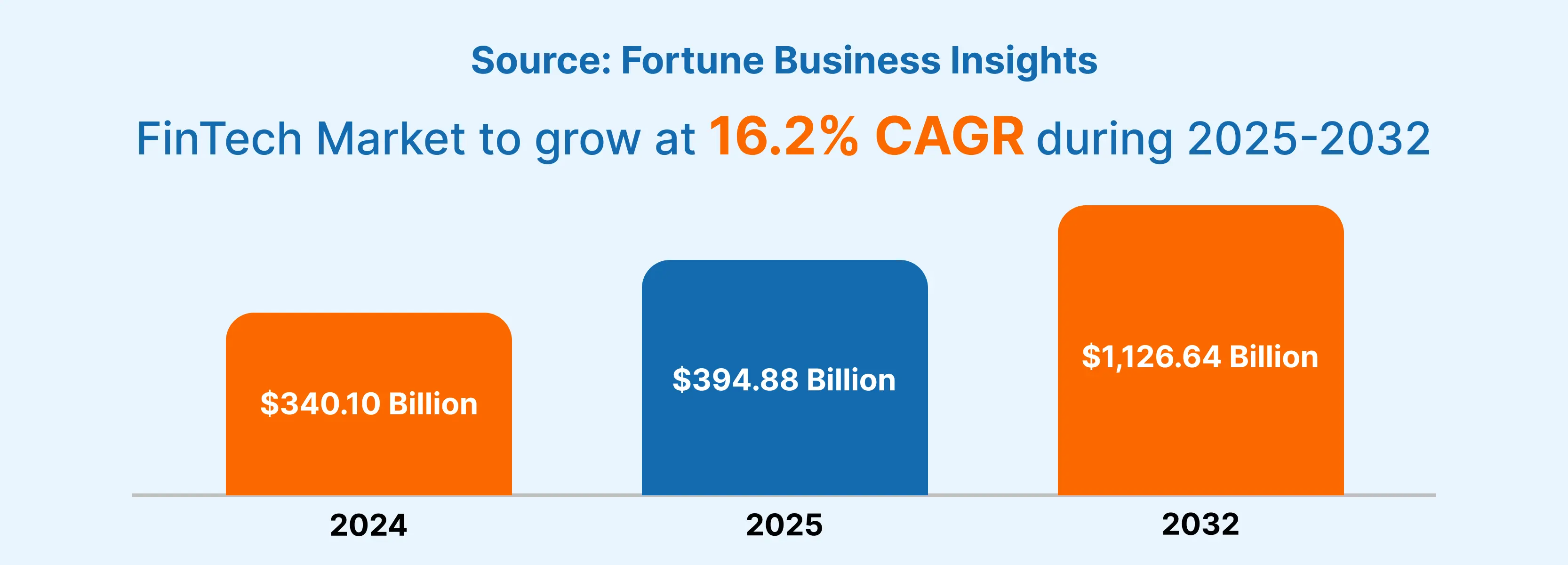

The fintech industry is expanding rapidly around the world. The global fintech market was valued at about $340 billion in 2024 and is expected to grow to over USD 1,126.64 billion by 2032, with an annual growth rate of around 16.2%. [Source: CoinLaw] This growth shows how strongly businesses and consumers are adopting digital financial tools.

About 38% of consumers now use AI-based financial tools, showing that people trust recommendations from algorithms. [Source: Fortune Business Insights]

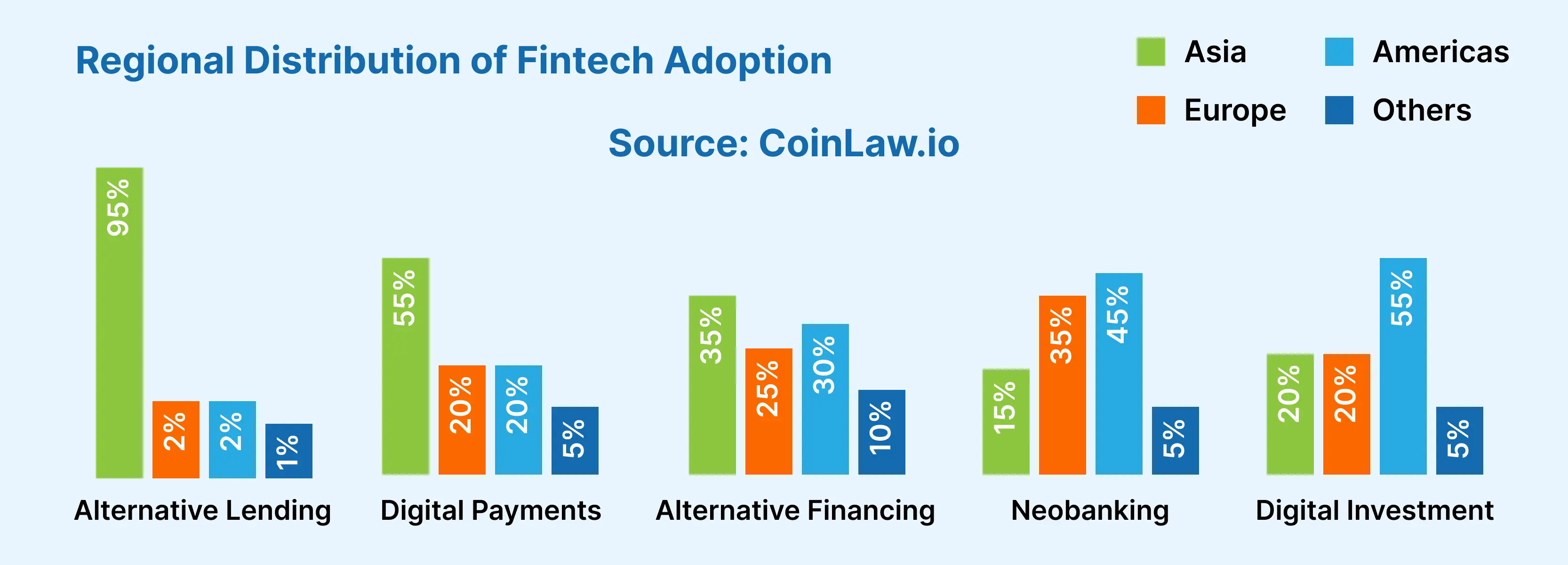

Regional Distribution of Fintech Adoption

- In Alternative Lending, Asia dominated with 95% of the global transaction value. Europe and the Americas had much smaller shares at 2% each, while other regions made up just 1%.

- For Digital Payments, Asia led with 55%, followed by Europe and the Americas at 20% each. The remaining 5% came from other regions.

- Alternative Financing was more evenly spread. Asia held 35%, the Americas 30%, Europe 25%, and other regions 10%.

- In Neobanking, the Americas had the largest share at 45%, Europe followed with 35%, Asia had 15%, and other regions accounted for 5%.

- For Digital Investment, the Americas led again with 55%, while Europe and Asia each had 20%, and other regions made up 5%.

The Potential of Blockchain in Fintech

Blockchain is a distributed ledger technology that records transactions across multiple systems, making the data difficult to change or manipulate. Each transaction is added as a block and linked to the previous one, creating a clear and secure record that can be verified by all participants. This structure helps improve transparency and reduces the risk of fraud.

Blockchain first gained attention through cryptocurrencies like Bitcoin, but its use in fintech has grown far beyond digital coins. Today, it is being used for secure payments, crossborder transfers, smart contracts, identity verification, and record keeping. By removing the need for middlemen and manual checks, blockchain helps lower costs, speed up processes, and build trust in financial transactions.

Blockchain supports secure digital transactions, cross-border payments, and decentralized finance (DeFi) systems. [Source: Konceptual AI]

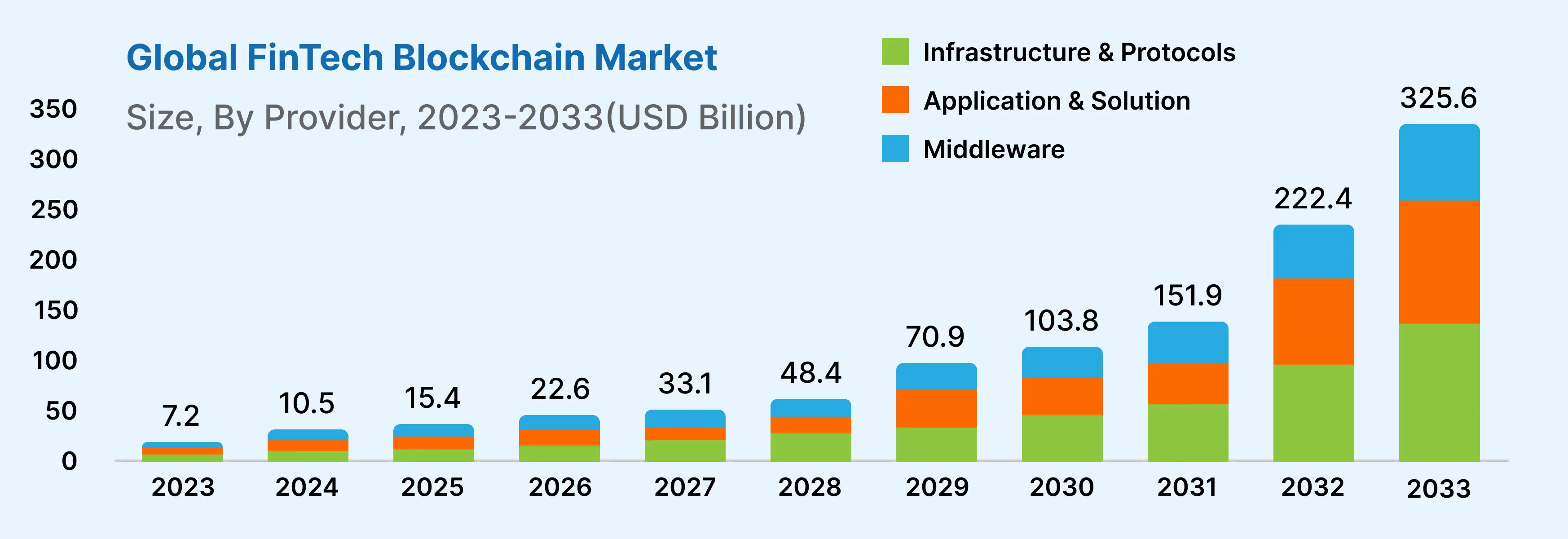

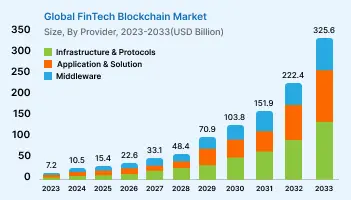

The Global FinTech Blockchain Market size is expected to be worth around USD 325.6 Billion by 2033, from USD 7.2 Billion in 2023, growing at a CAGR of 46.4% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 38.5% share, holding USD 2.7 Billion revenue. [Source: market.us]

Artificial Intelligence in Fintech

Artificial intelligence is another major force in the future of fintech. AI helps systems learn from data and make faster decisions.

AI Adoption and Impact

AI Adoption and Impact

Fraud detection: Around 60% of fintech companies use AI to detect fraud. [Source: SEO Sandwitch]

AI in fintech was projected to be worth nearly $17.93 billion in 2025 and could grow to over $60.63 billion by the early 2030s. [Source: CoinLaw]

Regional Market Insights

Regional Market Insights

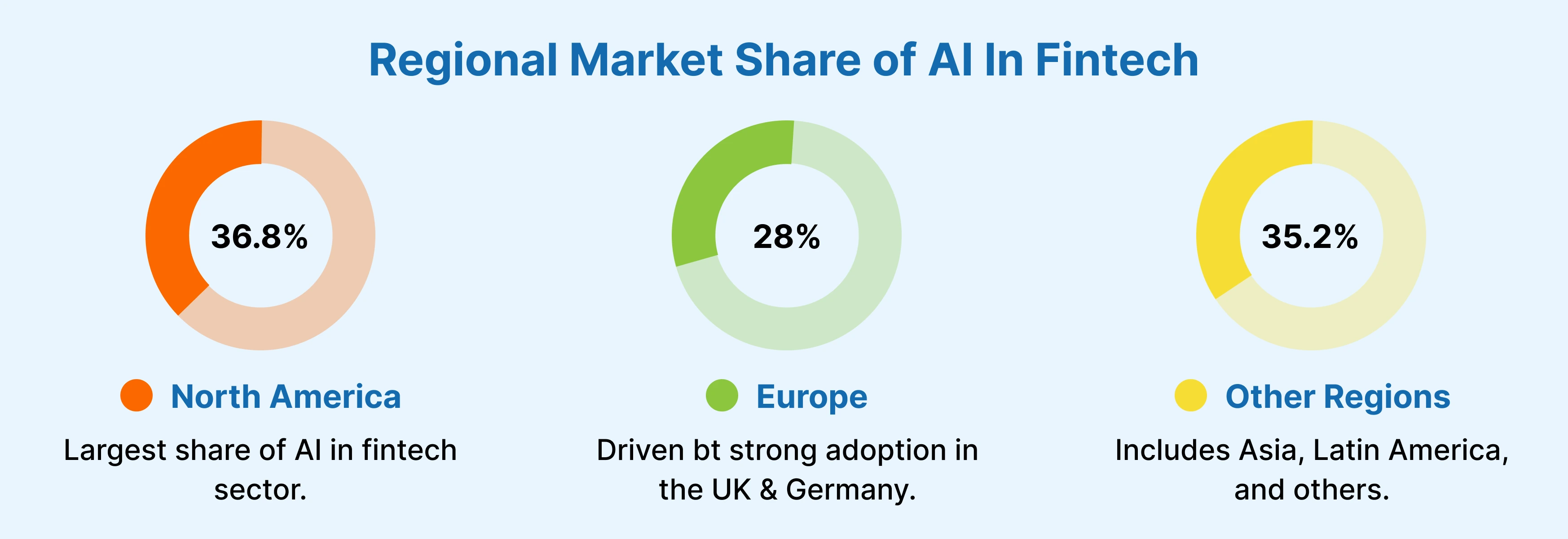

AI use in fintech differs across regions, with some markets growing faster due to higher investment and strong policy support. Below is a clear look at the regional trends shaping the AI fintech space in 2025.

North America leads the global AI fintech market with a 36.8% share. The U.S. fintech market is expected to reach $100.57 billion and grow at a 17.4% CAGR through 2031, supported by early adoption and strong funding.

Europe holds a 28% share of the global AI fintech market. The region is expected to grow at a 15% CAGR, driven by steady adoption in countries such as the UK and Germany, along with a strong focus on regulation and data security.

Asia-Pacific is the fastest-growing region in AI fintech. The market is projected to reach $11.2 billion by 2030, growing at a 19.7% CAGR. This growth is supported by major investments in China, India, and Singapore.

Latin America’s AI fintech market is expected to grow at an 18.5% CAGR and reach around $2.18 billion by 2030. Brazil and Mexico are leading adoption as digital payments and online lending continue to expand.

The Middle East and Africa region is projected to grow at an 18.1% CAGR, reaching $2.51 billion by 2030. Government-led digital finance programs in countries like the UAE and Saudi Arabia are bringing this growth.

Emerging markets in Southeast Asia and Africa are seeing higher fintech use due to wider access to mobile phones and the internet. AI is helping support financial inclusion by allowing low-cost digital banking and credit services.

Supportive policies and clear regulations have encouraged AI adoption in fintech. Countries such as Singapore, China, and the UAE stand out for promoting investment in AI research and fintech innovation.

The Role of Cloud-Native Solutions in Fintech

How These Technologies Work Together

The real strength of modern fintech comes from using blockchain, AI, and cloud-native solutions as part of one system. Each technology has its own role, but when used in the same environment, they support and improve one another.

Cloud platforms act as the foundation. They provide the computing power and storage needed to run AI models and blockchain networks at scale. This allows fintech companies to handle large numbers of users, process transactions quickly, and expand services across regions without building complex infrastructure.

AI adds intelligence to financial systems. It can study large sets of data stored on cloud platforms and identify patterns that humans might miss. For example, AI can detect unusual transaction behavior, predict fraud risks, assess creditworthiness, and offer personalized financial recommendations in real time.

Blockchain focuses on trust and data accuracy. It records transactions in a secure and transparent way, which helps ensure that the data AI uses is reliable. When data is consistent and tamper-resistant, AI insights become more accurate and dependable.

When these technologies are used within the same system, fintech companies can offer real-time services that are fast, secure, and scalable. Payments can be processed instantly, risks can be identified early, and systems can grow smoothly as demand increases. This combined approach is shaping the next phase of digital financial services.

Real World Examples

These technologies are already being used in real financial products and services. Below are a few examples that show how blockchain, AI, and cloud systems are working in practical ways.

Blockchain remittances

Blockchain remittances

Several fintech apps now use blockchain for cross-border money transfers. Traditional international payments can take days and involve high fees. Blockchain-based transfers can move money much faster and at a lower cost by reducing the number of intermediaries. This is especially useful for people sending money to family members in other countries.

Stablecoins for payments

Stablecoins for payments

Some companies are issuing stablecoins, which are digital currencies linked to traditional currencies like the US dollar. These are used to make payments more stable and predictable compared to regular cryptocurrencies. Stablecoins help businesses and individuals send and receive money across borders quickly, while avoiding large currency value changes.

AI-driven financial services

AI-driven financial services

AI is widely used to improve decision-making in finance. Many banks and fintech companies use AI to detect fraud, assess credit risk, and offer personalized product suggestions. Reports show that about 90 percent of financial institutions see AI as a major driver of innovation, especially in fast-growing markets like India where digital adoption is high.

These real-world examples show that fintech innovation is not just a future idea. It is already improving how money moves, how risks are managed, and how financial services reach people around the world.

Challenges and Potential Solutions

Along with the benefits of blockchain, AI, and cloud-native systems, fintech also faces some challenges.

Regulation

Regulation

As fintech technologies evolve, rules and regulations need to keep up to protect privacy, security, and fairness. Different rules in each country can be complicated, so companies often work closely with regulators and use tools to help monitor compliance automatically.

Integration with Existing Systems

Integration with Existing Systems

Many banks and financial institutions still rely on older systems. Adding AI or blockchain can be complicated and require careful planning. Companies often use modular systems and APIs to connect new technologies with existing ones without disrupting daily operations.

User Trust

User Trust

Customers and businesses need to feel confident that fintech systems are safe, reliable, and fair. Using strong security measures, clear reporting, and educating users about how services work helps build trust and encourage adoption.

Security and Costs

Security and Costs

Cybersecurity risks and compliance costs remain major concerns. Regular security checks, monitoring for unusual activity, and following best practices can help companies keep systems safe while managing expenses.

Addressing these challenges is key for fintech companies to grow responsibly and provide fast, secure, and reliable financial services for users around the world.

What’s Next for Fintech

Looking ahead, the future of fintech will likely include:

- Broader use of AI for personalization and automation across services.

- More blockchain applications beyond payments, such as digital identity and trade finance.

- Cloud-native platforms powering global digital banks and decentralized services.

- Increased adoption of embedded finance, where financial services are built into everyday apps and services.

Conclusion

The future of fintech lies where blockchain, AI, and cloud-native solutions come together. These technologies are transforming payments, lending, risk management, and customer experience. While challenges remain, their combined power is reshaping how financial services work and how people interact with money.

At Brevity Technology Solutions, we help businesses adopt the right fintech technologies so they can stay competitive and deliver better financial experiences.

Need help planning or building your next fintech project? Book a free consultation call with our team!

Related Post

-

F

-

A

-

Q

Fintech, short for financial technology, is the use of technology to provide financial services in faster and easier ways. It includes mobile banking apps, digital wallets, online lending platforms, trading tools, and AI-based financial services.

Blockchain records transactions in a secure and transparent way. It makes payments faster, reduces the need for middlemen like clearing houses, and improves cross-border money transfers.

AI helps fintech companies make smarter decisions. It can detect fraud, suggest personalized services to customers, automate support, and analyze large amounts of financial data quickly.

Cloud-native software is built to run in the cloud rather than on traditional servers. This allows fintech companies to scale easily, update systems faster, and serve users around the world without heavy infrastructure costs.

Many countries are updating rules to support fintech growth. They focus on safe use of AI, digital payments, and blockchain-based services while making sure consumers are protected.

DeFi stands for decentralized finance. It uses blockchain to offer financial services without traditional banks, such as lending, borrowing, and trading assets directly between users.

Fintech is not expected to fully replace banks. Instead, banks are adopting fintech technologies to improve their services, creating a hybrid model that combines technology with traditional banking.

AI can be safe if it is carefully monitored. Companies need risk controls, proper testing, and transparency to prevent mistakes or bias in financial decisions.

Fintech can make financial services faster, simpler, and more personalized. Mobile apps, AI chatbots, and instant payments reduce waiting times and make it easier for people to manage their money.

Yes. Small businesses can use fintech tools for payments, accounting, lending, and customer management. Cloud-based solutions make these services affordable, easy to use, and faster than traditional systems.

Want to Scale

Your Business? Let’s Meet & Discuss!

CANADA

30 Eglinton Ave W Mississauga, Ontario L5R 3E7

INDIA

3rd floor Purusharth Plaza, Amin Marg, Rajkot, Gujarat. 360002

Get a Quote Now

Let's delve into a thorough understanding of your challenges and explore potential solutions together